421-a Wasted $2.5 B in Tax Expenditures and It Is Coming Back to Waste More and Increase Gentrification

City wasted $2.5B in tax expenditures through 421a: IBO (Real Deal) Program doesn't fulfill its purpose, agency report charges * The New York City Independent Budget Office released a report on Monday that claims the city squandered $2.5 billion to $2.8 billion in tax expenditures from 2005 to 2015. The report asserts that these dollars were wasted because condo owners receiving the benefit saved more in taxes than they paid in higher sales prices. The agency — which looked at 101,477 condo sales over 11 years — points out that Manhattan condo owners paid a mean of $35,500 more for properties with the 421a tax abatement. The report found that Manhattan buyers paid between 53 to 61 percent of their tax benefits extra for their properties. In the outer boroughs, buyers paid a mean of $31,200 for condos with 421a — or 42 to 50 percent of the benefit that they are expected to receive. The crux of the report is that the tax benefit is being passed off to the condo buyer instead of the land owner/developer, when the program is ostensibly designed to encourage development. The IBO posits that the tax abatement therefore hasn’t fulfilled its purpose and may actually raise land and housing prices. (The developer would likely argue that the tax break is a major selling point — that it’s what makes the project feasible in the first place.) He also claimed that his program would’ve added 25,500 affordable housing units over 10 years, whereas the governor’s will only add 21,750. (The mayor’s math seems a bit different than the governor’s, which estimates that 2,500 affordable units each year would be created. A spokesperson for the Department of Housing Preservation and Development said the discrepancy is due to the small condo projects allowed outside Manhattan.) * A report by New York University’s Furman Center found that, under the latest 421-a tax abatement proposal, New York City would lose $2.6 to $5.7 million in tax revenue for each 300-unit building, The Wall Street Journal reports.

421-a May Return Wtih A Provision That Allows It to Target Gentrification Neighborhoods Pushing Out More Tenants and Mom and Pop Stores

ANOTHER BUDGET SHOT AT DE BLASIO -- POLITICO New York's : State legislation to revive a property tax break, whose expiration last year rocked New York's real estate industry and halted new rental projects, contains a significant benefit for outer-borough developers. A bill to bring back the 421-a exemption on new residential developments includes a provision that would allow buildings outside a previously designated zone to receive the tax break, so long as they satisfy other requirements in the legislation. Mayor Bill de Blasio's administration and the city's Independent Budget Office were each analyzing the possible impact of the new bill as of late last week. The addition of outer-borough rental buildings could have a significant impact on New York City's budget, depending on how many developers opt to construct large enough buildings to take advantage of the tax exemption. Only buildings with at least 300 units would be eligible for the tax break under the new language.*

Two Days Ago True News Said JCOPE Soft on Corrupt Glenwood Real Estate, Today NYP Agrees

Not One Elected Official or Good Govt Group Has Opposed JCOPE Low Fine Against Glenwood

JCOPE’s soft slaps at Glenwood and AFP prove it’s a joke, but the real problem lies with the politicians, who make the laws to benefit themselves, take the cash – no matter how smelly – and never, ever look back

The Low Fine Gives Real Estate the Green Light to Continuing to Buy Support in Albany

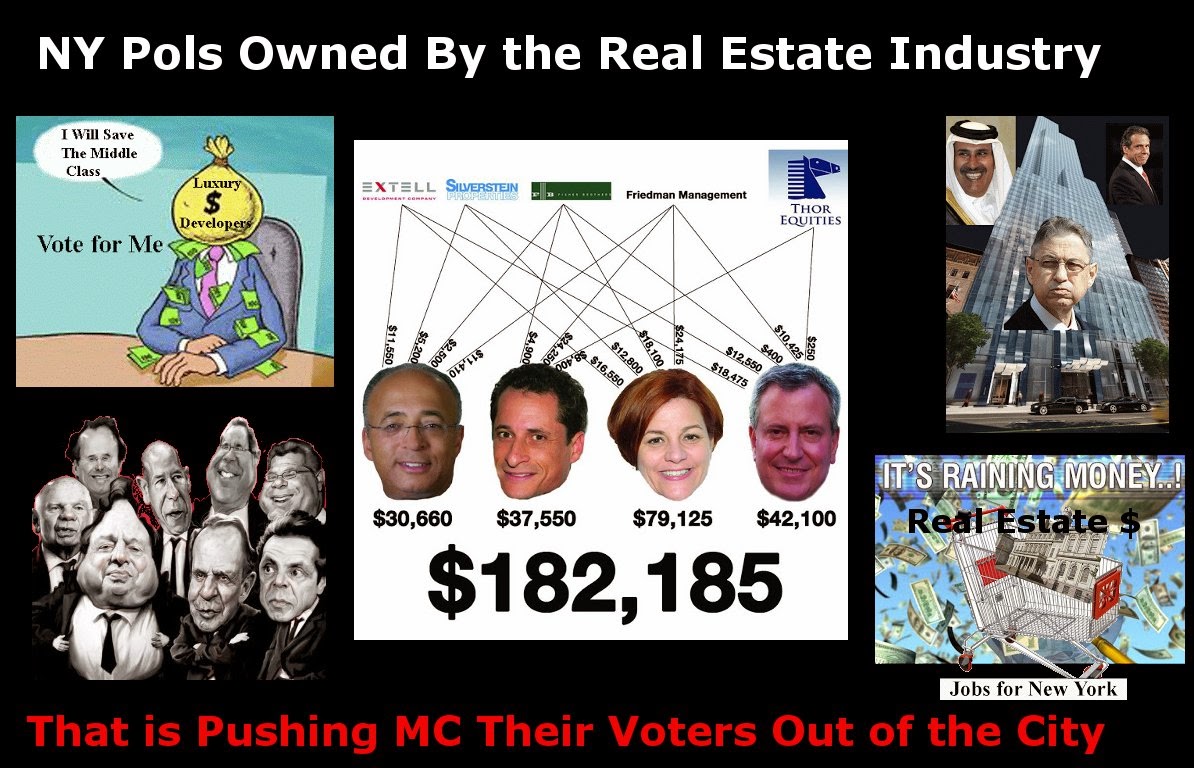

Why Developers of Manhattan Luxury Towers Give Millionsto Upstate Candidates (Pro Publica) A first-of-its-kind analysis shows just how tactical the real-estate industry is about bankrolling state legislators who will protect its $1.4 billion tax break and weaken rent laws. n 2014, an obscure campaign in the foothills west of Albany between a sheep farmer and a home builder mushroomed into one of the most expensive State Senate elections in New York history. Each side’s supporters spent at least $3.5 million, or more than four times the cost of the average U.S. House of Representatives contest that year. The bulk of money poured in from outside the district. Labor unions and national committees for campaign finance reform backed incumbent Democrat Cecilia Tkaczyk, the farmer. Some contributions to her opponent, Republican George Amedore Jr., which helped fund his television attack ads, were harder to trace. The money came from the Senate Republican Campaign Committee, which collected it from limited liability companies at glamorous Manhattan addresses, including Hawthorn Park, a 339-unit luxury tower with sweeping views of the Hudson River, as well as The Fairmont, The Encore and The Pavilion — all high-end rental towers. The LLCs, in turn, were arms of Glenwood Management, a developer of upscale Manhattan residential properties, and the New York real-estate industry’s largest contributor to political campaigns. Each election cycle, millions of dollars flow to Albany from luxury residential buildings, office towers and parking garages controlled by some of New York City’s biggest tycoons. What the buildings have in common is that they’re owned by LLCs, a structure shielded from New York’s tight restrictions on corporate campaign donations. Thanks to their vast networks of such entities, developers can give virtually unlimited sums each campaign season. In one day in 2014, Glenwood funneled $450,000 in contributions to two accounts for the Senate Republican Campaign Committee through 18 separate LLCs. Exploiting the LLC loophole has been a shrewd investment for the real-estate industry.

Wrong Dicker, if you add de Blasio's Campaign for One NY PAC He Got More From the Taxpayer Subsidized Developers

Fredric U. Dicker @fud31 "Cuomo was by far the largest recipient of donations from the taxpayer-subsidized developers."

A Developer Worth Billions Fined By JCOPE $270,000 For Corrupting the Assembly Speaker and Senate Majority Leaders- Lobbyists Walk

Companies fined $270k in Skelos, Silver cases (LoHud) wo companies involved in the corruption cases of the state's former legislative leaders have agreed to pay $270,000 to the state to settle alleged lobbying violations. The state Joint Commission on Public Ethics on Wednesday said Glenwood Management Corp. will pay a $200,000 penalty and the Administrators for the Professions, Inc. will pay $70,000. “The lawmakers who sought to use their official positions to secure unwarranted privileges have already been punished," JCOPE executive director Seth Agata said in a statement. "The clients of lobbyists who facilitated these acts and provided those public officers with such special benefits are now facing the consequences of their actions.” Silver was convicted on charges of pocketing more than $4 million that he disguised as legal payments from law firms specializing in real estate and asbestos claims. He was sentenced to 12 years in federal prison, but is free pending an appeal. In one scheme, Silver was found guilty of directing real-estate developers, including Glenwood Management, to hire Goldberg & Iryami, a Manhattan law firm that provided Silver with a cut of the business. In exchange, prosecutors said Silver used his influence to benefit the developers through legislation, particularly rent-control laws in 2011. In the JCOPE settlement, the agency said Glenwood acknowledged it retained the law firm "knowing that a portion of the fees paid would be shared with Silver, who would perform no work in connection with such legal services." Glenwood, also one of the state's largest campaign contributors, was a player in the Skelos case.

Skelos and his son, Adam, were convicted of scheming to use the senator's position to get more than $300,000 in work for his son from Glenwood. In the JCOPE settlement, Glenwood admitted it violated the state's Lobbying Act by "failing to disclose activities and meetings related to lobbying Skelos" in its public-disclosure reports and for failing to submit other registration information. "Glenwood also acknowledged that it recommended to an environmental technology company that the firm hire Skelos’s son, Adam, as a consultant, and arranged for another company to pay the younger Skelos a referral fee," JCOPE said. The elder Skelos was sentenced to five years in federal prison, while Adam Skelos was hit with a 6 1/2 year prison term. They are both appealing their convictions.

Almost No Media Coverage of the JCOPE Fines But Lots of Coverage During the Trial of Silver and Skelos for Pols to Give Back the Money

Cuomo Disguising 421-a As A Tax Incentives for Poor and Working Class, Now Called AffordableNY A Housing Program That Creates Gentrification and Pushes Out the Poor, Middle Class and Increases Homelessness by Raising Rents

Cuomo offers tax incentives in new affordable housing proposal for low-income New Yorkers (NYDN) The governor said he wants to replace a program designed to create apartments for poor and working class New Yorkers. The initiative would replace the 421-a program, which expired last year, granting property tax cuts to developers who set aside subsidized affordable apartments. Cuomo said the new program will create 2,500 units per year of affordable housing and will extend the tax incentives for 40 years. “It is actually in my opinion a better program than the old 421a,” he continued. “This has increased the length of affordability to 40 years, and it’s actually made it more affordable for people to qualify.” The governor did not discuss the length of the tax exemptions, the extent of the affordability mandates or other conditions imposed as eligibility requirements under the program. “It’s important to have a program like that to encourage private development and affordable housing in New York City.”*

Even the Lotteries for Affordable Apts Are Rigged to Get Young People to Gentrify Neighborhoods

Young singles are the big winners in NYC’s affordablehousing lottery: report (The Real Deal) The city’s affordable housing lottery between 2013 and 2015 was more likely to be won by young singles, according to data released by the Department of Housing Preservation and Development. And many of those young whippersnappers have developers to thank. More than half of the 48 housing lotteries for 1,470 available units across the city between January 2013 through to the end of 2015 were one-bedrooms and studios. Just over 40 percent of the winners in those lotteries were people aged 25 to 34, and half of those people were single, DNAinfo reported. The news website found that only 4 percent of the winners were over 62 years old. Just 11 percent were under the age of 25.

A Renewal of the 421-a Program Will Kill What is Left of Affordable Housing in NYC

Cuomo urges lawmakers to pass tax break for affordable housing (NYP) Building workers and real estate developers have struck a deal on a program that gives developers tax breaks for affordable housing and Gov. Cuomo is calling on lawmakers to return to Albany early to approve it. “The State Legislature has refused to release $2 billion in state affordable housing funds,” Cuomo said while announcing the deal late Thursday. “I urge the Legislature to come back to Albany to pass desperately needed affordable housing.” The program, known as 421-A gives developers up to $1 billion a year in tax breaks in exchange for dedicating a percentage of apartments to tenants with lower incomes than their neighbors. The program ended in January, after Gov. Cuomo told developers he would not renew it unless they could work out a deal with unions to improve wages for construction workers and other laborers who build the housing. The Real Estate Board of New York, the Building Contructions and Trades and Cuomo announced Thursday that all sides agreed to wages averaging $60 an hour for projects with at least 300 units in Manhattan. Workers in Brooklyn and Queens would earn an average of $45 an hour. Developers would avoid paying property taxes for 35 years, up from 21 years under the old terms of the program, in exchange for maintaining the affordable units for 40 year, up from 35 years previously. The deal could fall apart if the legislature does not approve it.*

Shocking NYT Cuomo Pushing For Another Tax Break for Developers

Cuomo Strikes Deal to Revive Affordable Housing Program (NYT) For the second time in three months, Gov. Andrew M. Cuomo has forged a deal with developers and union construction officials to revive a program designed to create apartments for poor and working-class New Yorkers. But will it get done? The program, known as 421-a, expired in January. It grants cuts in property taxes to developers who set aside subsidized apartments for low-, moderate- and middle-income families or individuals in their otherwise luxury projects. It is a city program governed by state legislation. As the number of homeless people in city shelters has climbed above 60,000, the creation of additional affordable housing has become a key goal for Mr. Cuomo and his political rival Mayor Bill de Blasio, both Democrats, although they have not often agreed on how to achieve it. The Cuomo administration has hoped that by reviving the 421-a program it would unlock $2 billion for the governor’s own housing program, which has been stalled for months without approval by leaders of the State Legislature. Under the new deal, builders would get the special tax benefits for a longer period — a 100 percent tax abatement for 35 years. A plan embraced by the mayor had called for a 25-year abatement followed by a phased-in return to full taxes over an additional 10 years. Details of the new deal were hashed out by state officials; members of the Real Estate Board of New York, the industry’s powerful lobbying arm; and union officials. They were announced on Thursday by the board, known as Rebny, and the governor. In the proposed version of the program, subsidized apartments would have to remain affordable for 40 years.

Now the Gov Wants to Subsidized 421-A Workers to Push Gentrification?

De Blasio: Subsidized wages for construction workers are fine — if it doesn’t cost city (NYP) Mayor de Blasio said he’s fine with the state subsidizing higher wages for construction workers who build affordable housing in the five boroughs – as long as it doesn’t impact the city’s bottom line. Asked about a report in the New York Times that Gov. Cuomo was considering reviving a suspended real estate tax break program with a proposal that would see tens of millions of state tax dollars going to ensuring union-level wages, de Blasio said “God bless ’em.” “If that’s what the state thinks is the right thing to do with state money, of course we can work with that,” he said at an unrelated press conference on parks in The Bronx. “What’s not acceptable to us is to add to the cost of the city’s affordable housing program, which is already stretched very thin and trying to reach half a million people.”* De Blasio cautiously supports affordable housing tax break for developers — as long as it doesn’t drive up costs(NYDN) * In Attempt to Convince Lawmakers to Vote for Affordable Housing Project, Mayor Appears to Anger Queens Councilman(NY1) * Allies of Bronx Borough President Wonder if Politics Played Role in Lack of Funding for Orchard Beach Pavilion Repairs(NY1)

* De Blasio, who has made creating more affordable housing a priority, has faced fierce community opposition on specific projects, slowing his plans to build more units as a larger push to keep New York affordable for working class people, The Wall Street Journal writes * Critics rip Cuomo plan that combines tax and wage subsidies (NYDN) * A proposal to revive the lucrative 421-a affordable housing tax credit for developers by providing government wage subsidies for the workers they hire is being blasted by business groups, nonprofit providers and economic experts, the Daily News reports. * Cuomo wants the government to pay union workers higher wages (NYP) * Why Cuomo wants you to pay unions to build luxury housing (NYP) What Andrew Cuomo did this month was like a parody of a black-and-white 1940s movie about beefing kids in the alley. Bully No. 1 has a baseball bat: “Why I oughta smash your head in!” Bully No. 2 has a knife: “I’m gonna slice you up good.” It’s a standoff, until along comes Andrew, kindly and whistling, the grown-up, the soothing Bing Crosby character. “What seems to be the trouble, boys?” says Bing Cuomo. The two bullies explain themselves. “He owes me money!” “No, he owes me money!” And that’s when you happen into the picture. Yes you, the entirely innocent New York taxpayer, the random citizen who happens to be walking by.

Cuomo Wants to Use Government Money to Revive Gentrification Causing 421-a

Cost of a good intention on 421-a fix (NYDN) At the urging of construction unions, the governor smashed the renewal of a property tax break, called 421-a, that is crucial to building housing, including affordable units, in the city. By demanding a so-called prevailing wage rate, Cuomo threw the economics entirely out of whack. He prevailed on the state Legislature to bake into law an unusual mandate for the Real Estate Board of New York, representing developers, and the construction unions to work out wage rates both could live with. Without such an agreement, the law fated 421-a to die. The two sides failed to reach a deal, and no wonder: financing higher wages on top of the affordable housing would bust the developers’ tight budgets, rendering many projects unbuildable. To break a months-long logjam, Cuomo now looks to dedicate potentially tens of millions of dollars of state taxpayers’ money to achieve private sector wage hikes that are acceptable to the unions.He pledges to kick in $15 an hour on wages of up to $65 for workers on large rental towers in Manhattan south of 96th St. and $50 on the booming Brooklyn-Queens waterfront.

At a time when New York desperately needs housing, affordable housing most of all, the governor has boosted the cost and put the taxpayer on the hook.

Tip of the Iceberg of Construction Corruption As One Boss Goes to Jail

Construction official gets jail-time for safety-inspection scandal (NYP) A Manhattan construction official busted for site-safety fraud in 2014 was sentenced Tuesday to one to three years in prison for his part in a citywide scam that included sending hairdressers, cooks and bellhops — often hired off Craigslist — to impersonate licensed safety managers. Richard Marini, 62, manager of the firm Avanti Building Consultants, was allowed to cop to a charge of grand larceny in a plea bargain last October. He was one of several construction officials indicted for sending random people they hired via online postings to impersonate licensed safety managers at dozens of high-rise projects across Manhattan , including the Upper East Side, the Financial District and Gramercy Park

Developers Get to Make Noise At Night

A tale of two noises: De Blasio’s unequal ‘quality of life’ crusade (NYP) On Sunday, his team announced a deal to halve tourist helicopter flights. The same day, The Post reported on the jump in permits for loud overnight construction work. De Blasio’s Economic Development Corp. says the chopper deal will cut 30,000 Downtown Manhattan Heliport flights a year. No more Sunday flights either, or ones over Governor’s Island . Yet the city’s doing nothing about another ear-ache: As Isabel Vincent and Melissa Klein reported in Sunday’s Post, the Buildings Department OK’d 59,895 permits last year for work between 6 p.m. and 7 a.m. — a 24 percent jump from 2014. It nixed only 431 applications, for an approval rate of 99 percent. ’Copter-noise complaints make up a minuscule share (less than 1 percent) of all noise-related 311 calls. But one resident calls night-time construction work an “indescribable nightmare.” Machines make it impossible to sleep, and filing complaints “does not work,” says Isabel Madden, who lives near a project at 220 Central Park South.* Developers, DOBlove night construction, but residents not so much (Real Deal)

* The Post writes that helicopter noise complaints make up a“miniscule share” of calls to 311 about noise concerns, and the de Blasio administration is not addressing the “ear-ache” stemming from night-time construction work: * Post writes that helicopter noise complaints make up a “miniscule share” of calls to 311 about noise concerns, and the de Blasio administration is not addressing the “ear-ache” stemming from night-time construction work:

Developers Pay Millions to Get Tenants in the Way Out

New York Builders Paying Huge Buyouts to Tenants in TheirWay (NYT) Tishman Speyer Properties, one of New York City ’s most active real estate developers, had bought two parcels of land on the Far West Side of Manhattan to clear the way for a 2.8 million-square-foot office tower planned for Hudson Yards. Standing in the way, though, were the occupants of two apartments on the site. So this year, the developer turned to a lubricant that can be counted on to ease New York City tenants out of their rent-regulated units — a buyout, in this case, for $25 million in total to three tenants.* de Blasio's defense of donations from developers = "the ends justify the means" (which sounds like Markowitz) (AYO)

Will There Be A Son of 421-a?

The Real EstateCommunity Is Scrambling to Get the Lapsed 421a Tax Break Back (NYO) Real estate leaders, the abatement’s many vocal opponents and elected officials on both sides of the issue now must brace for the impact of another lapse. The 421a tax break involves the city’s history, its politics and its economy. The tax break started in the 1970s at a time when some worried whether anyone would want to build new housing in the city. The current impasse between REBNY and the Building Trades Council comes with some concerned the demand for new housing in the city will push everyone but the very wealthy out.

A Symbol From the 421-a Era the Poor Door Building Opens

‘Poor door’ tenants reveal luxury tower’s financial ‘apartheid’ (NYP) The controversial “poor door” at a luxury Lincoln Square tower is finally open — and creating New York-style financial apartheid. Tenants who were chosen to live in one of the 55 low-income units in Extell’s ritzy 33-story building recently started trickling in through the poor door — and many are disturbed by the glaring disparities. A tenant from the “rich” side took no issue with the separate and unequal residences, claiming, “It’s unfortunate to make it into a class warfare,” and, “It’s not us against them.”The luxury building’s “poor door” is at 40 Riverside Blvd. The main entrance is around the corner.Photo: Helayne Seidman However, the resident, who requested anonymity, admitted he had never mingled with his less-fortunate neighbors.To qualify for an “affordable” rental, a family of four must earn less than $50,000 per year, and an individual no more than $35,000. About 90,000 people applied for the 55 units.

The Daily News Ignoring the Gentrification Push Out Damage 421-a Has Done Pushes for Albany to Renew the Program

The Daily News Also Ignores the Corruption of Silver and Silver by 421-a Developer Glenwood and their Lobbyists

Unaffordable mess:What to do now that a 421-a prevailing wage deal has fallen to pieces (NYDN Ed) With a tick of the clock Friday, a foundation of Mayor de Blasio’s affordable-housing plans imploded, jeopardizing upwards of 20,000 of the 80,000 affordable apartments he aspires to build. Now the Legislature that set the stage for this debacle must swiftly restore what too-casual deal-making destroyed. Namely, a decades-old New York City program, called 421-a, that greatly reduces property taxes for new housing development, thereby encouraging new construction that in many cases would otherwise be infeasible.

421-a Has Expired Another Death Nail for de Blasio's Affordable Housing and Zoning Plan

It’s official, the 421-a tax break meant to encourage the construction of affordable housing in NYC has expired. * AYR ) * Construction-union officials said they failed to reach a deal with real estate leaders on worker wages in an agreement needed to renew the critical 421-a property-tax exemption program in New York City , The Wall Street Journalreports:

The Feds Just Blew Up NYC's Luxury Housing Market Bubble Feds: 421-a Luxury Buildings Hiding Dirty Money

Feds To Track Secret Buyers of Luxury Real Estate..(NYT) * Feds crack down on rich foreigners’ favorite money-laundering scheme (NYP)* Millionaire, show thyself: What does the Treasury Dept.’smove mean for NYC real estate? (Raw Deal)* The 421-a property-tax exemption program that has played a central role for decades in the construction of apartment buildings across New York City appeared headed for trouble as negotiations bogged down between developers and construction unions. under the terms of a deal hashed out in last year’s state budget, the deadline for a deal is tomorrow.* Cuomo Distances Himself From 421a Talks (YNN) * The feds just blew up the allure of New York City's high-end-condo market:anonymity * The Times writes that the U.S. Treasury Department hastaken a good step, but should broaden a program that will demand the identities of those behind shell companies that “rich foreigners” use to buy real estate in Manhattan and Miami-Dade County

As 421-a Dies So Does the Mayor's Affordable Housing Plan

Death of Tax-Break Program Could Hamper Mayor de Blasio’s Housing Push (NYT) Mr. de Blasio said on Monday that his administration was creating housing affordable to poor and working-class New Yorkers faster than any of his predecessors. That drive may soon hit a speed bump.* On Friday, New York City Mayor Bill de Blasio’s affordable housing agenda may encounter a roadblock because it’s unlikely construction unions and real estate developers will agree on wages in time to renew the 421-a tax break, the Times reports: * In the latest sign of New York City ’s booming real estate market, the total market value for all property has crossed the trillion-dollar mark for the first time in history.

Will There Be A Son of 421-a?

The Real EstateCommunity Is Scrambling to Get the Lapsed 421a Tax Break Back (NYO) Real estate leaders, the abatement’s many vocal opponents and elected officials on both sides of the issue now must brace for the impact of another lapse. The 421a tax break involves the city’s history, its politics and its economy. The tax break started in the 1970s at a time when some worried whether anyone would want to build new housing in the city. The current impasse between REBNY and the Building Trades Council comes with some concerned the demand for new housing in the city will push everyone but the very wealthy out.

421-a Too Many Making Money May Get Extended to Destroy More Neighborhoods

421-A TALKS IMPROVING, THOUGH UNCERTAIN - POLITICO New York New York 's real estate lobby and building trades union must agree on a wage plan for buildings with more than 15 units. Without a deal, the state's 421-a program, which sunset on Dec. 31, would officially lapse and the new law would be moot. he two sides have been talking regularly and are scheduled to meet again on Thursday* Town Hall on Homelessness takes aim at @Billdeblasio housing plan * Mayor Bill de Blasio says he's on track to reach hisaffordable housing goals. (NY1)

A Possible Win for Union and Loss for de Blasio and Neighborhoods

Union win would be huge blow to de Blasio’s affordable housing plan (NYP) The city would have to come up with an additional $2.8 billion for affordable housing if unions win their fight to force developers to pay “prevailing wages” on affordable-housing projects, the Independent Budget Office said Monday. The office found that the cost of each affordable unit would increase by $45,000 if the higher wages were enacted, delivering a significant blow to Mayor de Blasio’s plan to build 80,000 new apartments. The Real Estate Board of New York said the IBO’s analysis supports the board’s stance that higher wages would either boost government spending or produce fewer units.* The New York City Independent Budget Office estimated the cost of each affordable housing unit would increase $45,000 if constructed by those earning prevailing wages, as requested by unions, the Post reports: * The Daily News applauds de Blasio’s progress on buildingor preserving affordable housing, but says that the clock should run out on the 421-a tax break and it should be taken up by the Legislature this session: * Bill de Blasio Struggles to Sell NYCHA Residents on His Planto Save Public Housing * * The de Blasio administration would have to come up with an additional $2.8 billion for affordable housing if unions win their fight to force developers to pay “prevailing wages” on affordable-housing projects, the Independent Budget Office said.

The Media Needs to Look At the Damage Silver Did to Tenants With the 421-a Program

Who suffered from New York pols' payoff cases? (Times Union ) Defense for key state legislators downplays impact, but others say society, people do suffer. According to Silver's attorney, he was a "great champion" of tenants rights during a time when rents in New York City have soared. According to a 2014 study released by the Community Service Society, between 2002 and 2011, New York City lost 385,000 units of housing affordable to low-income residents — over 40 percent of units in that category. But during his trial, Silver was found to have arranged payments from developers to a law firm that handled property tax appeals for real estate companies, yielding hundreds of thousands of dollars in fees for the speaker. In 2011, lobbyists for one of those developers, Glenwood Management, met with Silver to push the luxury apartment builders' agenda on the lucrative 421-a tax break program, which incentivizes the building of affordable housing, as well as rent regulations — both then close to expiring. According to testimony from one lobbyist, Richard Runes, Glenwood ended up getting largely what it wanted out of the renewal of both programs. "We knew Senate Republicans were in the pocket of the real estate industry, so that wasn't a surprise," tenant activist Michael McKee told the Times Union, describing the 2011 negotiations. "What was really surprising was that Sheldon Silver sold us out after he had positioned himself as this great defender of tenants' rights." McKee added, "They made very minor alterations at the very edges and called it a great tenant victory while they left every loophole in place so that Glenwood could get more (market-rate) units into the system."* Despite the Crackdown, 421a Tax Benefits Still Falls in theWrong Hands (Citylimits)

How the Tax Payers Buy Apt Complexes for Wall Street Billionaires

Who do billionaires turn to when they want to buy apartmentcomplexes? The U.S.taxpayer (Bloomberg) Barry Sternlicht’s Starwood Capital Group and Stephen Schwarzman’s Blackstone Group LP are in talks with Freddie Mac to finance two transactions totaling more than $10 billion, according to people with knowledge of the negotiations. Those discussions come after the government-owned mortgage giant already agreed to back Lone Star Funds’ $7.6 billion deal to buy Home Properties Inc. and Brookfield Asset Management Inc.’s $2.5 billion takeover of Associated Estates Realty Corp. The mortgage guarantor -- which along with its larger counterpart Fannie Mae was rescued in a $187.5 billion taxpayer bailout in 2008 -- is boosting its multifamily lending as their regulator eases restrictions on that part of their business. Cheap debt from the U.S.-backed companies is helping sustain a five-year surge in values for apartment buildings and fueling some of the biggest real estate deals since the financial crisis.

Real Estate Developers, Tax Breakes and Politics, 421-a

Daily News Says More Info On Secret by Mayor Giving Blackstone's Stuy Town Deal on Air Rights and Forgiving Loan

The Daily News writes that straight accountings of deBlasio’s real estate dabblings are needed after he did not mention the city was forgiving a loan and authorizing an air rights sale at Stuyvesant Town and Peter Cooper Village: * Editorial: Fulldisclosure, please (NYDN Ed) As a huge landlord reached a deal buy Stuyvesant Town and Peter Cooper Village, de Blasio trumpeted success in keeping almost half of the complexes affordable to the middle class. The mayor said that the city reached advantageous terms with the Blackstone Group. But what did Blackstone really get in the deal? New York “will fund a loan of up to $144 million,” de Blasio’s press release stated — without mentioning that he was actually forgiving the entire sum, plus $77 million, for a total $221 million. It turns out he added artificial sweetener: the mayor will help Blackstone get the okay to sell development rights that experts say are potentially worth $100 million to $350 million. New Yorkers need straight accountings of the costs of de Blasio real estate dabblings. Here that extends to the possible air rights bonanza. At least, the terms should have said that the bulk of any such sums would come back to taxpayers. * The Post writes that de Blasio should keep his “grubbypaws” off the city’s pension fund after the mayor suggested he may like to invest it in various subsidized housing program as part of his affordable housing program: *The recent sale of Stuy Town-Peter Cooper Village highlights the differences between the massive Manhattan complex and Parkchester, its similarly-designed Bronx counterpart with much lower rents, Crain’s reports: * Blackstone-Ivanhoe Cambridge Purchase of Stuyvesant Town-Peter Cooper Village

Not One Borough Like de Blasio Rezoning Plan So Far

Bronx, Queens, Brooklyn and Manhattan Throw An Zoning Tea Party for de Blasio

Not one borough likesde Blasio’s rezoning plan so far (NYP) Manhattan

Green Shoots of Opposition to Developers in the Bronx, Manhattan and Brooklyn

Bill’s housingboomerang (NYDN Ed) Mayor de Blasio should hardly be surprised by widespread opposition to one of his key strategies for encouraging affordable housing — because, but for his current job title, he would surely be rallying the throngs in protest. From Riverdale to Morrisania, from Inwood to Hell’s Kitchen, from Williamsburg to Sheepshead Bay Bronx , where three in five households spend more a third of their incomes on rent, every board rejected de Blasio’s plan. Borough President Ruben Diaz — joined by six of nine Bronx Council members — also voted no on the borough board. In East New York, Brooklyn , the board roundly rejected de Blasio’s proposal to put affordable housing mandates and subsidies into action. Speaker Melissa Mark-Viverito says she supports the mayor’s concept but abstained on the Bronx borough board’s vote. In lieu of leadership, she blah-blahs about “a meaningful discussion about neighborhood goals, values and priorities.”

After Rejection to His Rezoning Plan: Blaz to Community Boards: Drop Dead

As public advocate and mayoral candidate, he fought the closure of Brooklyn’s bankrupt Long Island College Hospital, which was located in prime real estate, declaring at one point: “People’s health — not the profits of the real estate industry — needs to be our priority.” Two years later, the hospital is gone and a developer has the right to erect luxury housing. The builder has proposed a better deal: Permit construction of a slightly larger project in exchange for including hundreds of affordable apartments, a new school and a park. Local leaders, including Councilman Brad Lander, say no. They’ll stick with the high-priced units to keep the project as small as possible.* Faced with a community board backlash against his zoning plans for affordable housing, New York City Mayor de Blasio went to a Bronx church Sunday to pitch his plan as a needed bulwark against New York becoming a “gilded city,” the DailyNews reports: * Faced with a neighborhood backlash against his zoning plans for affordable housing, NYC Mayor Bill de Blasio went to a Bronx church to pitch his plan as a needed bulwark against New York becoming a “gilded city.” He argued that since development is inevitable, the city is better off working to make sure it doesn’t totally leave out the poor and middle class.* Re affordable housing zoning plan resistance, @BilldeBlasio says community boards inform decision but aren't decision makers* Cuomo: City has gotten more than its fair share in housing funds (PoliticoNY) ‘They are significantly higher than as prescribed in the law’ * Gov. Cuomo: State has been

Opposition in the Mayor Own Circle to Rezoning East New York and the Bronx Fears of Gentrification

Anti-poverty activists allied with de Blasio are sharply criticizing his plan to rezone East New York , a low-income neighborhood at the heart of his affordable-housing initiative,the Journal reports: * The Bronx Borough Board — which includes area politicians and community leaders — became the fourth to vote against or raise concerns about zoning changes tied to de Blasio’s affordable housing plan, the DailyNews reports: * de-Blasted: Four boroughs just roasted @BilldeBlasio's plan for affordable housing. (NYDN).* Manhattan leaders are pushing back against two zoningchanges connected to the mayor's affordable housing plan: * Staten Island Community Board 3 Latest to Vote Down City's Rezoning Plan(DNAINFO) *Mayor's East New York-Ocean Hill Rezoning PlanRejected by CB16 (DNAINFO) * LES Community Board Votes Down City

It Could Be the Lack of A Union Agreement That Kills 421-a Not the Gentrification Damage the Program Does to the Neighborhoods

Months of discussions between construction union leaders and representatives of New York City’s real estate community haven’t produced an agreement on wage levels for construction using the 421-a tax abatement, and many people involved in discussions are increasingly prepared for no deal to be reached, The Wall Street Journal reports: * As a January deadline looms, real estate industry and union leaders have yet to hammer out a deal on 421-a abatement.

NYC Real Estate Barrons' Found Their Puppet A Progressive Mayor to Gentrify East New York

The study, "The Effects of Neighborhood Change on NYCHA Residents," written by the consulting firm Abt Associates with help from New York University's Furman Center for Real Estate, found that NYCHA tenants often wind up feeling like aliens in their own neighborhoods, surrounded by newcomers who claimed they'd just "discovered" the neighborhood. “NYCHA residents could be priced out of new private amenities and new, higher-income neighbors may not contribute to accessible community resources,” the report reads.* * New York City hired five NYCHA residents as urban “interpreters” who gathered information for a $250,000 report that concluded most New Yorkers already accept as true: gentrification doesn't help the poor,the Daily News reports de Blasio Spins Back The city's voluntary inclusionary housing program, which rewards developers who set aside apartments for low rents, yielded more than triple the number of units in fiscal year 2015 than it did previous year,Politico New York reports:

Pay to Play Brooklyn Bridge Park Apartments for Board Directors

Brooklyn Bridge Park Bigwigs Bought Condos in Disputed Pierhouse -- and city lawyers told them that was just fine. (DNAINFO) Two Brooklyn Bridge Park board members — who helped approve a luxury residential development that critics say blocks coveted views — were among the first to buy condos in the controversial tower last year, DNAinfo New York has learned. David Offensend and Henry Gutman, then-members of the Brooklyn Bridge Park Brooklyn Bridge from the Promenade, Brooklyn Heights ’ walkway over the East River , and has sparked protests from neighbors and an unsuccessful lawsuit to halt its construction.The Brooklyn Bridge Park Corporation approved and oversaw the creation of the building on state land and will receive the property taxes generated there. Offensend, who stepped down from the park corporation’s Board of Directors in July, and Gutman, who remains on the board, got clearance from the city's Law Department to buy units in the tony building, which includes a screening room, a pet wash station and a "young adults study" room, according to documents filed with the state. * Activists protest de Blasio pal’s view-blocking high-rise(NYP) * Even Bloomberg's parks commissioner says Brooklyn Bridge ParkCorp broke its promise on too-tall luxury condos

The Future of 421-a

Two powerful trade organizations that control the fate of a controversial property-tax exemption known as 421-a will begin determining the program’s future as soon as late September.

Daily News Says It Against Luxury 421-a But Says Nothing About the Gentrification Push Out the Tax Break Causes

Time to end a hugetax break for wealthy property owners (NYDN Ed) Tiny property taxes for the most luxurious of luxury condominiums. A bigger tax bill for rental buildings where the have-nots live. It’s a tale of two cities — told most offensively though the towering bauble for the ultrawealthy known as One57, where a top-floor residence recently sold for a record $100 million. Outrage properly greeted the Daily News’ revelation in 2013 that One57’s developer had secured from the state Legislature clearance to claim a property tax break known as 421-a. Savings to the wealthy residents: $9.4 million a year. Still worse, the city Independent Budget Office now calculates One57 got an additional $16 million property tax discount last year, thanks to a state law that places insanely low assessed values on the city’s priciest condos and co-ops.

New Real Estate Disclosure of Shell Companies Buying Up Luxury Apts

New Disclosure Rules for Shell Companies in New York Luxury Real Estate Sales (NYT) The changes, spurred in part by a recent investigation by The New York Times, will help remove a “veil of secrecy” in high-end sales, a city official said.

421-a is Shortchanging Affordable Housing, Causes Corruption and Closes Small Business and Blacks Out of Their Homes

421-a $905,000 an Affordable Apartment, City $190,000 Per Affordable Housing Apartments

City was shortchanged on affordable housing: report (NYP) The city was shortchanged on the number of affordable apartments created under the 421-a property-tax abatement that state lawmakers gave the developer of the luxury Midtown residential tower One57, according to a report issued Tuesday. The Independent Budget Office found that the $65.6 million in taxes forgiven to One57 over a decade could have produced roughly five times the 66 units created under the subsidy. Paying affordable-housing developers directly would have garnered the city as many as 367 units with the same amount of money, while a separate program that gives nonprofits tax breaks to operate low-rent housing could have yielded 320 units, the analysis found. The smaller number of affordable units actually created in The Bronx cost taxpayers $905,000 per apartment.

By contrast, direct funding to developers of low-income housing would have run the city $179,000 per unit, the IBO said. “The staggering cost and inefficiency of this program is precisely why the administration sought — and succeeded in — ending 421-a tax breaks for luxury condominiums,” said City Hall spokesman Wiley Norvell. “The practice was just indefensible.” At the city’s urging, Albany lawmakers made reforms to the 421-a program that the IBO said would create 13,000 more affordable apartments, but at an added cost of $3.3 billion. The reforms are set to go into effect in January, but only if the real estate industry can come to a deal on wages with the construction industry. Otherwise, the current 421-a program would be extended as is. * Some are interpreting the wording of the new rent law to actually make it more difficult for landlords to deregulate apartments when rent reaches the established threshold, much to the chagrin of those property owners. * A group of Brooklyn elected officials led by Borough President Eric Adams are set to meettonight to map out a plan to push for changes next year to the rent regulation law, though it’s highly unlikely the GOP-lead state Senate will revisit the issue. * The recently-revised 421-a tax break will cost New York City $3.3 billion over 10 years in foregone revenue, according to a new estimate from the city’s Independent Budget Office.* * Language in the new rent regulation laws may actually make it more difficult for landlords to deregulate apartments when rent reaches the established threshold, but landlords say they believe it to be a drafting error that Albany lawmakers need to fix, Gotham Gazette reports: * Bed-Stuy is Focus of Concerns Over Fate of Community Gardens (City Limits) The city has identified 181 small city-owned sites for potential affordable-housing development. Eighteen currently have community gardens on them. Ten of those gardens are in Bedford-Stuyvesant.* One57 is getting $66M in tax breaks for contributing $6M toaffordable housing in the Bronx: (Curbed) * * A recent report by the Independent Budget Office suggests that class-warriors have missed the real target by opposing 421-a tax abatement and should instead look at other breaks helping developers pay less in taxes, the Post writes: * The Real Estate Board of New York spent $3 million opposing a prevailing wage provisionin the renewal of the 421a tax abatement.

421-a Causing Rent Up Losing the Middle Class Also "Middle class families in NY are now looking forother states to live in due to the cost of living in the state..''

Pols Killing Existing Affordable Housing With 421-a and Airbnb While Protecting Rent Regulations Laws for Votes

421-a Approve By the Lawmakers and Airbnb Not Stopped By the Lawmakers Destroying Affordable Housing, Not Just Vacancy Decontrol

A group of 14 Democratic state lawmakers is urging Cuomo to strictly enforce the new rent regulation law to save tens of thousands of apartments from going into the free market over the next four years. * COMBATTING GENTRIFICATION: Brooklyn Borough President Eric Adams writes in City & State describes four factors exacerbating the negative effects of gentrification, from landlord harassment of tenants to a fear of change: * Gov. Andrew Cuomo said he would likely steer clear of the talks to finalize the 421-a tax abatement, which, without an agreement reached by labor and real-estate developers, would expire, State of Politics reports: * Major chain of NYCthree-quarter houses in financial ruin (NYDN) A co-op on West 106th Street that was nursed back to life by tenants who took it over from a deadbeat landlord decades ago has slipped back into disrepair after board members began using it as their own personal piggy bank, according to a lawsuit filed by tenants. * Board of AffordableHousing Co-Op Accused of Using Building as Piggy Bank (DNAINFO) While the building piles on debt, the president, vice president and secretary/treasure have been collecting monthly salaries of $1,600, $1,000 and $650 respectively since 2006, court papers say. The lawsuit claims the board members improperly "stacked the corporation with shareholders who are related or associated with them," used co-op fund to renovate apartments of family and friends, and failed to maintain proper finance records, among other claims. * Cuomo ‘Sure’ Labor And Developers Will Reach Deal On 421a (YNN)

de Blasio's Market Rate Affordable Housing

De Blasio admin is touting 'affordable' apartments forseveral hundred dollars more than market rate: (DNAINFO) — Dozens of studios that rent for $1,900 a month and one-bedrooms that will fetch more than $2,000 a month are about to be up for grabs at a Lefferts Avenue building touted by the city as affordable housing. The city's Department of Housing Preservation and Development sent out a notice on Tuesday that it's now taking applications to fill 46 newly constructed apartments in the former condo building.

Brooklyn Borough President Eric Adams said during a City& State TV interview that he has not heard from the governor since sleeping in front of Cuomo’s office to draw attention to the 421-a tax abatement: * State Comptroller Thomas DiNapoli’s office said an auditfound some applicants who were next in line for Mitchell-Lama apartments were skipped over for those farther down the waiting list: * Cuomo seems to be on a base-tending campaign, which involves meeting with unions and reminding them of his position on the 421-a property tax rebate debate earlier this year, Capital New York reports: * New York City is entering what could be the biggest building boom in a generation, as work gets under way on hundreds of residential projects in neighborhoods across the city, The Wall Street Journalreports: * New York City is entering what could be the biggest building boom in a generation, census figures show, as work gets under way on hundreds of residential projects in neighborhoods across the city. * Prospective tenants are cutting the line at two Mitchell-Lama developments, a new audit by state Comptroller Thomas DiNapoli revealed. * Adams: Cuomo didn’t push hard enough on rent (Capital)

Talk About Pouring Oil On A Fire: Chinese $$$ Flooding NYC Real Estate Market

BIG APPLE OR BEIJING? Chinese investors are flooding New York City real estate market like never before (NYDN)Manhattan real estate, a more than threefold increase over what they spent in all of 2014, according to data from Real Capital Analytics. And outbound capital from China going into U.S. commercial real estate transactions topped $10 billion in 2014 for the first time, after 72% average annual increases since 2010, according to commercial brokerage CBRE. “Canadians used to be the No. 1 residential foreign buyers in the New York . Now, it’s the Chinese,” said real estate attorney Ross Moskowitz of Stroock & Stroock & Lavan. “We have seen some domestic buyers backing away from deals because they realize they’re going to be outbid.”A New York City housing boom (CrainsNY) The latest census data reveal that 42,088 permits were issued to developers in the first six months of 2015, more than in any full year in five decades.

What is the Daily News Talking About That Bharara is Looking into the 421-a Tax Breaks?

Both the Arrests By U.S. Attorney Bharara of Silver and Skelos Were Tied to the 421-a Program

The tax break cost the city $1.1 billion last year and is now the subject of an ongoing federal probe. In January 2013 Albany snuck a provision onto a budget bill that awarded the break to One57 and four other big Manhattan developments. The developers of these buildings are all big campaign donors. The tax break deal was first examined by Gov. Cuomo's Moreland Commission until he disbanded it. Now it's being looked at by Manhattan U.S. Attorney Preet Bharara.

What the Daily News Did Not Report On Was the 421-a Program has Tripled the Rent in Neighborhoods Like Crown Heights Moving Black Out

How NYC perpetuates segregation (NYDN) True News wrote last year How Blacks the Poor and the Middle Class are Being Push Out of Brooklyn Because of Albany's Tax Breaks for Luxury Developers * Landlord trying to swap renters for ‘rich, white tenants': suit (NYP) *

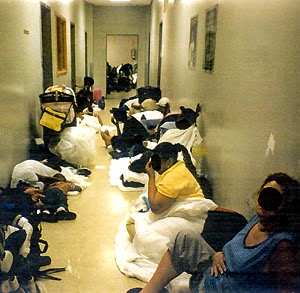

SWEATING IT OUT: Brownsville tenants live without hot water and electricity (NYDN) * Crown Heights, Brooklyn, Gets Its Turn(NYT) The neighborhood has finally overcome a reputation for intolerance and violence that had plagued it since the 1991 riots between blacks and Hasidic Jews. In fact, residents credit the successful post-riot reconciliation between the two communities with being one of the drivers of Crown Heights Franklin Avenue , signs saying “Moving to Flatbush” have appeared on many businesses in the last couple of years, and while longtime residents don’t tack up signs, there are indications they have also been leaving in large numbers as new arrivals replace them in this community of about 140,000 people. * An Independent Budget Office report found a tax break for One57, a luxury condo tower in Midtown, will cost New York City $65.6 million in property taxes over 10 years, money that could have paid for 367 affordable apartments, theDaily News reports:

How de Blasio Historic 421-a Astoria Cove Deal Does Not Have Enough Affordable Housing 4 Tax Break

A de Blasio 'game changer' falls short of 421-a requirements (Capital) Astoria Cove, the premier mandatory affordable housing project of the de Blasio administration, will not qualify for a 421-a tax break under the newly passed version of the law. The Queens development, which the City Council approved with much fanfare in November, is obligated to set aside 27 percent of its units for affordable housing. But the specifics of the plan do not meet the new requirements under the revised state law, leaving its future uncertain. The deal that developer Alma Realty struck with the Council requires that it provide 5 percent of the units at or below 60 percent of the Area Median Income; 15 percent at 80 percent of the A.M.I. and 7 percent at 125 percent of the A.M.I.

The city then agreed to subsidize another 34 affordable units—2 percent of the total—by giving the developer a extra $4.8 million. None of the affordability requirements laid out under the 421-a deal struck in Albany last month match that model. To meet that threshold, Alma would have to offer more deeply affordable units at lower rents. It would likely lose its city subsidy. * Recent strike raises issue about 421a program extension (NYDN) * The recently changed 421-a tax break will cost New York City $3.3 billion over 10 years in foregone revenue, in addition to current lost revenue, according to a new estimate from the city’s Independent Budget Office, Capital New York writes:

NYC Real Estate Barrons' Found Their Puppet A Progressive Mayor to Gentrify East New York

The study, "The Effects of Neighborhood Change on NYCHA Residents," written by the consulting firm Abt Associates with help from New York University's Furman Center for Real Estate, found that NYCHA tenants often wind up feeling like aliens in their own neighborhoods, surrounded by newcomers who claimed they'd just "discovered" the neighborhood. “NYCHA residents could be priced out of new private amenities and new, higher-income neighbors may not contribute to accessible community resources,” the report reads.* * New York City hired five NYCHA residents as urban “interpreters” who gathered information for a $250,000 report that concluded most New Yorkers already accept as true: gentrification doesn't help the poor,the Daily News reports de Blasio Spins Back The city's voluntary inclusionary housing program, which rewards developers who set aside apartments for low rents, yielded more than triple the number of units in fiscal year 2015 than it did previous year,Politico New York reports:

Lobbyist For the Astoria Astoria Park

Broker: Homeless Hurting Real Estate . . . Not Doing to Well for the Homeless Either

The NYT Says de Blasio's 421-a Plan is A Tax Give Away to Developers

At the same time, the mayor would eliminate the 421-a tax break for luxury condominiums, a booming market that needs no support from the city, especially in Manhattan . One problem is that he would give excessively long tax breaks to developers of other apartments, if they provided more low-cost housing. Instead of the 20 to 25 years granted now, developers would get up to 35 years. That is a long time to go without paying their normal share of city taxes. New York campaign protecting rent-stabilizedtenants (NYDN)

The Daily News like de Blasio 421-a Plan Ignores the Tax Give Away and Corruption Arrests in Albany

"Take, for example,the hotly contested 421-a tax break issue. (NYDN Ed) Designed to encourage housing construction at a time when the market was in the doldrums, the law offers benefits to developers that are now too generous. Its formulas need to be rewritten — but neither the Senate nor the Assembly crafted a bill to achieve the objective. Nor did Cuomo. De Blasio stepped into the vacuum on May 7, delivering to Albany a complex plan to adjust the breaks and to use them more effectively as a catalyst for affordable housing production. The product of consultations with housing advocates and developers, de Blasio’s scheme thoughtfully balanced economics and social policy."

More on Gentrification

How Blacks the Poor and the Middle Class are Being Push Out of Brooklyn Because of Albany's Tax Breaks for Luxury Developers

Affordable Housing Invented By Elected Officials to Protect Them Against 421-a Gentrification Push Out

De Blasio short of lowest-income housing goals so far (Capital) de Blasio’s administration has, so far, fallen considerably short of its goals for producing housing affordable to New York ’s poorest residents. Between the start of 2014 and the end of March, the city says, it closed on financing for nearly 18,400 affordable apartments—some to be preserved, others to be created from scratch. Less than 15 percent of those units, or about 2,700, are for residents earning salaries considered to be “very low” and “extremely low” income. That’s well below the targets of the mayor’s ambitious housing plan, which seeks to create or preserve 200,000 apartments in a decade. The plan says 20 percent of those units should be for those two lowest-income brackets, which top out at less than $42,000 per year for a family of four—or half the area median income. So far, just 14.5 percent of the units the city has closed on since the mayor took office have met those standards. That’s worse than how former mayor Michael Bloomberg did, at least during the three-year period for which reliable data is available. Between fiscal years 2009 and 2011, there were about 38,600 affordable apartments built or preserved in New York City ,according to a report from the Association for Neighborhood and Housing Development. Of that, 19.8 percent were affordable to families making less than 50 percent of the area median income.

NYT Reports On Landlords and Developers Buying Up Bed-Stuy But Ignores the Cancer (421-a) Driving the Gentrification Market

In Bed-Stuy Housing Market, Profit and Preservation Battle (NYT) A tall and slender man of 60, he has lived several blocks from the cleaners for close to a year now, during which he has watched investors and developers canvass the streets looking for properties from which they might extract significant profits. “They’re up and down here every day,” he told me, as he recounted getting approached by someone who offered him money to unearth information about the owners of a neighboring townhouse. It is standard in Bedford-Stuyvesant to see posters calling on locals to join the dubious mission of turnover.

“If you find someone who want to sell you will get up to $20.000.00 for finder fee,” reads one, somewhat inexplicably. In response to all of this, fliers in the neighborhood recently warned older black homeowners, many living in brownstones passed down through generations, to protect themselves from getting bilked by predatory, and by implication, racist real-estate interests. (“Free leg or thigh if you sell your grandma’s deed!” one of them proclaimed. This particular enticement to fury ran under the headline “Landgrabbers Realty Corp.,” and featured a drawing of a drumstick.) It is hard to overstate the acquisition frenzy that hangs over Bedford-Stuyvesant, and to reconcile it with some of the realities that persist in the neighborhood, where the felony assault rate is more than three times what it is in Park Slope. When I met Mr. Leow and his team last week — a team that includes a young broker named Mipam Thurman, the brother of the actress Uma Thurman, who told me he had to move to Flatbush because he couldn’t afford to buy anything in Bedford-Stuyvesant — they showed me a house on Lafayette Avenue that had just gone into contract for slightly under the asking price of $1,550,000. * Anti-Gentrification Fliers Plastered Throughout Stuyvesant Heights in Bed Stuy (Brownstone) *

Who is Happy About the 421-a Extension?

Heastie on Big Ugly says: 'Once we get through the details I think the conference will be fine.' Members still need to approve the deal * No agreement on pension forfeiture * Cuomo won't go into detail about vacancy decontrol. Said taxpayers can expect "hundreds of dollars" back for the property tax rebate program * Details on luxury/vacancy decontrol in rent deal? @nygovcuomo declines, says he wants to give leaders a chance to brief their members. * .@NYGovCuomo says he is not disappointed education tax credit didn't fly in assembly. Says private schools will get support they need: $250M * Those rent-law loophole fixes better be damn good: @NYSA_Majority just traded them for 421-a luxury tax break extension. #affordablehousing * .@NYGovCuomo did not get special monitor he wanted for cases involving civilian deaths at hands of police. Will appoint special prosecutor * Cuomo, State Lawmakers Announce Framework Deal (YNN)* Schneiderman Attacks ‘Punting’ of ContentiousIssues in Albany * Cuomo Points To AFL-CIO Opposition To de Blasio 421A Plan (YNN) * Assembly session previously scheduled for today has been cancelled. Will be rescheduled for 9:30 am tomorrow. * Tenant Groups Detest Rent Law Deal, Unions Praise 421-a Move (City Limits) * Alliance for Tenant Power: Gov "made empty promises & lied repeatedly" while helping the Senate Rs advance "a massive giveaway to landlord."

Last Month de Blasio Said End 421-a is Not Reformed, Well Not Reformed

de Blasio If 421-a is Not Reformed End It

The transcript of de Blasio's church remarks from this morning includes audience responses: "This city works when it's for everyone," @BilldeBlasio says, and "gentrification has changed us."* "If Albany won't mend it, let's end it," @BilldeBlasio says of 421-a. * .@BilldeBlasio for 1st time calling for 421a to end altogether if he doesn't get changes he wants. "End those tax breaks once and for all" * .@BilldeBlasio says $100 million condo got a tax break. "Not anymore, brothers and sisters." Friday De Blasio hints at compromise with Albany on 421-a | Capital * Cuomo Digs at de Blasio on Real Estate Tax Plan * for first time @BilldeBlasio proposes ending #421a if Albanydoesn't get on board w/ his reforms to the abatement: (Capital) * State lawmakers mustend tax breaks for housing developers if they won’t amend it: Bill de Blasio * Both Dean Skelos and Sheldon Silver skipped out of the end of the legislative session early, and Silver declined to vote on the rent control and 421a tax abatement extensions. * New York City Mayor Bill de Blasio called the 421a tax credit plan passed in Albany a partial victory and noted it now required developers building in all parts of the city to include affordable housing, the Observer reports:

How In A City of 8.3 Million People is there No Opposition to the 421-a Tax Give Aways to Developers?

Upper East Side estate last summer, he opted to rent out his Park Slope residence. The financial disclosure, which only provides a broad range of incomes, shows he took in between $15,000 and $144,000 from the three rental units.

NY Conservative Party Supports de Blasio's 431-a Extension Plan

De Blasio and Conservative Party make unlikely team in property-tax fight (NYP) The debate over a $1 billion New York City property tax abatement program has created the strangest political bedfellows of them all — the state Conservative party and the city’s progressive mayor. Conservative Party chairman Mike Long on Thursday praised Mayor de Blasio for opposing the inclusion of “prevailing wages” for construction workers as part of a 421-a tax abatement program to spur developers to build more affordable housing. Albany over his plans to revamp the 421-a tax abatement program, Capital New Yorkreports: * Crain’s Editorial Board writes that for now, Mayor Bill de Blasio’s plan for 421-a is the best one, because forcing developers to pay a prevailing wage would ensure that no 421-a developments happen:

True News Wags the NYT On the Harm the 421-a Program Does

NYT Responds to True News Reporting That 421-a Is Destroying NYC Housing

De Blasio’s Housing Push Spurs Anxiety Among Those It’s Meant to Help (NYT) Mayor Bill de Blasio’s drive to build 80,000 apartments to combat income inequality has aroused fears of more gentrification and more displacement.* The New York City Independent Budget Office released a report on the effect the 2008 changes to the 421-a tax credit have had on the location of the buildings that utilize the tax exemption: *vCalls to Reform 421-a Grow As Deadline Looms(YNN) * A coalition pushing for a “prevailing wage” for building trades workers at developments getting 421a tax breaks has lined up the support of the New York State AFL-CIO, the state’s 2.5 million-member umbrella labor group.

Last Week True News Wrote:

The NYT Real Estate Ruse Distruction Blinders

The Victims of 421-a, Gentrification, Closed Hospitals Ignored by NYT

Are the Homeless the Real Victims of the Developers, NYT?

Homeless in New York City, an Unending Crisis (NYT Ed) Without support from political leaders, the number of people forced to live on the streets will continue to rise.

Are the People Being Forced Out of Bushwick By Gentrification the Victims, NYT?

Displaced, Dispersed, Disappeared: What Happens toFamilies Forced Out of Bushwick? (City Limits)

Are the Tenants Who Landlord to Push Out In Gentrifying Neighborhoods Victims, NYT?

BrooklynLandlords Accused Of Trashing Apartments Arrested (WCBS) An alleged Brooklyn slumlord and his brother were arrested Thursday morning, accused of creating appalling and squalid conditions for tenants. Joel Israel and his brother, Amram, were led in handcuffs into the courthouse in downtown Brooklyn on Thursday for their arraignment, CBS2’s Valerie Castro reported. * 2 Brooklyn Landlords Accused of Making Units Unlivable AreArrested (NYT) *Brothers Joel and Aaron Israel—collectively forming JBI Management— made headlines last year for taking such drastic measures as blasting a crater-sized hole in the middle of one family's Bushwick apartment at 98 Linden Street, as well as incurring similar miseries on the occupants of other properties in Greenpoint and Williamsburg.* NYT Calls the Speyer's Victims of Skelos. But the Real Victims Are the New Yorkers On the Short End of Speyer's and Their Real Estate Gang Tax Break Development Ripping Apart People's Lives

Do the People Who Will Die Because of Closed Hospital by Developers Victims, NYT?

Rudin's St. Vincent's site will have five individualized condo ...(NYT) * De Blasio’s proposal to reform the 421-a tax abatement program would allow some landlords whose benefits are scheduled to expire soon to keep them under certain conditions, Capital New York reports:

de Blasio Unchanged 421-a Give Away is A Giver Away to Developers

Media Covers the Fight Not What 421-a Does to Tenants Who Live in gentrifying Neighborhoods

After meeting with legislative leaders and the governor in Albany , NYC Mayor Bill de Blasio said it would be “irresponsible” for state lawmakers to simply extend a controversial tax break known as 421a that he considers a “giveaway” to developers. * Cuomo Points To AFL-CIO Opposition To de Blasio 421A Plan (YNN)

The Pols Have Created A Gentrification Market Where Scam Predators Target Minorities to Flip Their Homes

Real Estate Shell CompaniesScheme to Defraud Owners Out of Their Homes (NYT) Relying on the secrecy of limited liability companies, white-collar thieves are targeting pockets of New York City for fraudulent deed transfers, leaving the victims groping for redress. In Bedford-Stuyvesant and other pockets of the city, white-collar criminals are employing a variety of schemes to snatch properties from their owners. Often, they use the secrecy afforded to shell companies to rent out vacated properties until they are caught or sell them to third parties. Victims are left groping for redress, unable to identify their predators or even, in some cases, to prove a crime has been committed. Attention lately has focused on the growing use of shell companies to buy prized real estate in Manhattan and other glittering destinations for global wealth. But the stealthy practice of deed theft illustrates another way that limited liability company law used to create such entities has been twisted and stretched to conceal the ownership of real estate. This is particularly true in Brooklyn neighborhoods where profits in the hundreds of thousands of dollars from quick turnaround sales have become common.In other cases, signatures are simply forged on deeds. The thieves, meanwhile, hide behind inscrutable mazes of limited liability companies, rented post office boxes and fake addresses. Coming amid waves of gentrification, the reports of deed theft have helped feed the unease felt in neighborhoods where longtime residents — blacks and Hispanics, the poor and middle class — are increasingly being priced out.* Real estate shell companies are defrauding New York City residents out of their homes, and a growing number of fraudulent deed transfers are often difficult to crack due to the secrecy of limited liability companies, The NewYork Times reports:

How Blacks the Poor and the Middle Class are Being Push Out of Brooklyn Because of Albany's Tax Breaks for Luxury Developers

Airbnb Bad Neighbors, Warehouses Apartments -- Rising Rents and IncreasingGentrification:

Cuomo Calls de Blasio A Fake Progressive Giving Away Tax Payer Money to Developers

de Blasio Strikes Back Saturday

New York City Mayor Bill de Blasio issued his harshest attack of Gov. Andrew Cuomo yet, saying Cuomo puts out distractions to stymie the city’s agenda and fails to show leadership, Newsday writes: * Cuomo said complicated issues cannot get done with “thisSenate and Assembly” in a matter of days, in response to de Blasio’s 421-a proposal and Attorney General Eric Schneiderman’s ethics plan, the Times Union reports:

Cuomo raises the stakes in ongoing feud with de Blasio (NYP) Cuomo took his feud with Mayor de Blasio to a whole new level Thursday by accusing the ultra-progressive mayor of trying to engineer a “giveaway to developers.” A day after meeting with de Blasio, the governor charged that the deal the mayor made with the real-estate industry to extend the 421-a tax-abatement program to help produce more affordable housing was a windfall for developers. “A lot of people think the deal negotiated by the city is too rich for developers and not enough for workers,” Cuomo told reporters after touring the Greene County Correctional Facility near Albany on Thursday. Turning the tables on de Blasio, Cuomo said the mayor’s progressive agenda doesn’t give construction workers who build the housing “fair wages” and dismissed de Blasio’s comment that he was “frustrated” after a lobbying trip to Albany Wednesday. “

The mayor of New York is almost perpetually frustrated with Albany ,” Cuomo said. “The city is a creature of the state, so the state Legislature passes laws that affect the city. So when the mayor wants to make a change, he has to go to Albany and ask Albany .” The body slams came as Cuomo supporters and labor-union leaders essentially called the mayor a hypocrite. * Cuomo suggested de Blasio waited too long to engage in the Legislature’s negotiations on the extension of mayoral control of city schools and rent regulations, the Daily News reports: Another Clueless Story Despite spending months trying to understand Cuomo, de Blasio’s aides concluded little that can be done to improve their relationship because of “fundamental power dynamics,” The Wall Street Journal reports: * The Post writes that de Blasio’s cool reception in Albany shows making political speeches in Iowa and California and whining about New Yorkers not appreciating you is a poor way to get what you want from the state: “Mayor of the City of New York , frustrated with Albany ?” Cuomo said, barely containing his laughter. “Now there’s a shocker.” * The latest flashpoint between the two top Democrats is 421a – the real estate development tax abatement program that expires next month. Cuomo stepped things up a notch by accusing the ultra-progressive mayor of trying to engineer a “giveaway to developers.” * Thirty-second ads slamming de Blasio for backing a rent freeze, paid for by the Rent Stabilization Association, have begun airing on NY1 and News12 in Brooklyn and the Bronx ahead of the June 24 Rent Guidelines Board vote.* Ad campaign charges de Blasio as hypocrite for backing arent freeze (NYDN) * "The UP4NYC and carpenters group statements camefrom the same email address at the PR firm, M Public Affairs." (YNN) * Labor Groups Push Cuomo’s 421a Plan (YNN) * Cuomo Digs at de Blasio on Real Estate Tax Plan,But Claims No ‘Clear Right or Wrong’ (NYO) * Gov. Andrew Cuomo continued to criticize de Blasio’s proposed changes to the state’s 421-a tax break for developers, even as he claimed to be undecided on how the program should be reformed, the Observer reports: * Affordable housing advocates are urging Democratic Assembly Speaker Carl Heastie to “stand strong” against a “straight extender” of current rent regulations, even as a June 15 expiration date for the laws looms, the Times Union reports * While the 421-a tax credit has bought great benefit tocondo owners in New York,its absence has not deterred buyers on several projects built )without thecredit, Crain’s writes: * Cuomo: Questions remain on both sides 421-a debate (Capital) * De Blasio’s Office Touts Slights Against Cuomoin TV Interview (NYO)

A Progressive Mayor Working With Developers Against Prevailing Wages?

Has Anyone Notice the Mayor is Pushing for Renewal of 421-a With Changes for More Affordable Housing. What About Gentrification Displacement?

NYC Mayor Bill de Blasio is playing it both ways on whether developers who get huge tax breaks through the 421a program to build affordable apartments in the city must pay workers prevailing wages. More here. * PLAYING IT BOTH WAYS: Mayor de Blasio dismisses idea of prevailing wage for construction workers from developers with big tax breaks (NYDN) It's a tale of two de Blasios. The mayor is playing it both ways on whether developers who get huge tax breaks to build affordable apartments in the city must pay workers prevailing wages. * The state AFL-CIO released a statement blasting typically pro-union de Blasio for his plan to extend the 421-a tax abatement without a prevailing wage mandate for construction workers, the Times Union writes: Butts Blasts Mayor De Blasio brushes aside criticism from Butts (Capital)

Albany is considering extending when it expires June 15. Flashback Bill de Blasio'sclaim that money will have no sway over his decisions as mayor will be put tothe test (NYDN 2013) The special interests who contributed to de Blasio's campaign will be eager to see if he shows his gratitude when he starts making decisions in City Hall. * Real estate opens checkbook for de Blasio | Crain's New York (2013) * REBNY Banquet | De Blasio Real Estate * @AFLCIO presidentopposes straight extension of 421-a tax break

Does the Daily News Really Believe That the 421-a Tax Give Away Has Increased Affordable Housing in the City? Does the Daily News Believe 421-a Increased Political Corruption?

Not constructive,fellas: The building trades and Gov. Cuomo undermine a smart and balanced deBlasio affordable housing reform plan (NYDN)

Willets Point Businesses Close Development in Doubt

How NY's Tax Payers Subsidized A Saudi Billionaire With 421-a Tax Brake

A Saudi billionaire is in contract to buy a $95 millionsky-high penthouse (NYP) Fawaz Al Hokair, a retail/real-estate kingpin worth an estimated $1.37 billion, reportedly signed a contract for the lofty unit at 432 Park Ave. Caucasus , according to the Real Deal. The law gives property owners a 10-year pass on real estate taxes—so the buyer of the $115 million penthouse would have an annual bill of under $18,000, when they would typically owe $300,000. The Tax Breaks Go to the Developers Though Hidden Fees As if to offer some warped concept of "balance," the article notes that these tax breaks could be offset by obscenely high hidden fees tacked on to the sale agreements (the proceeds of which go to the developers, not state or city coffers).

At 432 Park Avenue , which will be the tallest condo in the Northern Hemisphere when it opens in 2015, full-floor penthouses are priced between $72.5 million and $95 million and will be saddled with common charges of more than $17,000 a month. On top of those costly common charges come fees like the mandatory membership in the building’s gym, known as The Club at 432 Park Avenue , which bases its charges on the size of the apartment, with larger units owing more. Then there is the $2,000 that owners are required to pay annually toward the building’s dining room, and the additional $1,200 in private dining services that owners are required to buy annually, whether or not they use the restaurant. * Exemption Gives Rich People Obscene Real Estate Tax Breaks (Gothamist) * How the Rich Geta Big Real Estate Tax Break (NYT) * The 1% Get A New Park Avenue High Rise And Tax Cuts While Homeless Suffer From Budget Cuts * Removing condos from the 421-a tax abatement program may impact first-time homebuyers disproportionately, but will likely not scare buyers away, Crain’s New Yorkwrites: * Luxe buildings aim to please with cruise-like activities (NYP) Breaking A crane operating atop an office tower in Midtown Manhattanstruck several adjacent buildings, sending debris falling (NYT) 10 hurt in crane accident in #Midtown #Manhattan; surrounding streets closed off * At least 10 hurt after crane smashes into Midtown building (NYP) * City's systemic shameful failure to enforce its laws. Sdhave moratorium on new laws until we can enforce the old. (NYT) * Crane Collapse in Midtown Manhattan Injures 7 and Damages Buildings (NYT) Wednesday City seeks to arrest building owners that violate safety rules (NYP)

de Blasio A Tale of Two 421-a's

de Blaiso Spins A Black Chruch That 421-a Was Only About Tax Breaks for Luxury Buildings